We all know how easy it is to spend the money we’ve been blessed with. We are pros at loading up our Target cart every week and hitting up the mall each season for a new wardrobe. But are you good at keeping track of all those purchases? Do you really know how much money you are bringing in each month versus how much money is going out? Are you confident in your money management skills? Do you have a budget that works for you and your family? If not, we are here to help! We will teach you the basics of setting up a monthly budget, as well as how to stick to that budget, which is the key to your financial success.

Creating a Budget

1. Make the Budget.

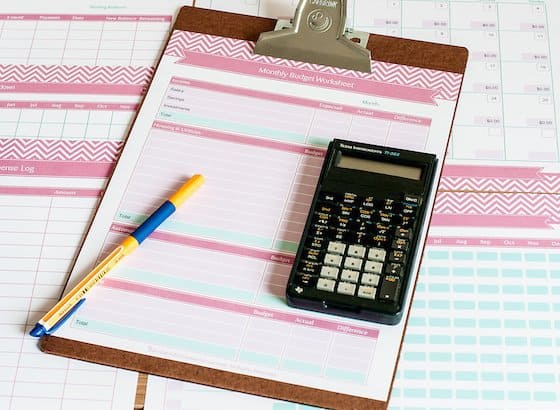

You can create your budget whichever way best works for you; pen and paper, a spreadsheet, or a handy budgeting form. Make your budget a few days before the month begins so you’re ready. Each month, you must make a new budget, because the numbers will vary from month to month. Maybe not drastically, but you have to allow for living your life, which means this month you’ll have to account for the 50 hamburgers you’re buying for the family reunion, and next month you’ll have to pay for the sky-high water bill from filling up the baby pool every afternoon.

2. Income.

Figure out how much money you bring in this month. Account for every source of income, not just paychecks. Write that number down.

3. Outgo.

You will then tell every dollar where to go, which will leave you with $0 at the end of the month. This is called a zero-based budget. This doesn’t mean you spend every dollar, it simply means you tell each dollar where it belongs. Ever wonder by the end of the month where the heck all your money went? Now you will know.

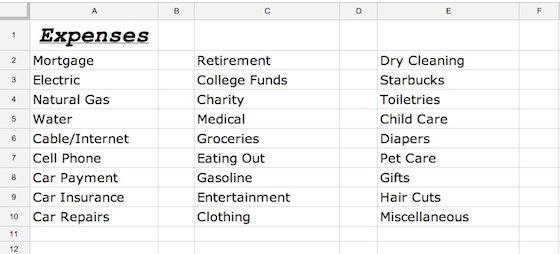

Write down every anticipated expense you have for this month. Make categories. Be as specific and detailed as possible when creating categories so you’ll be less likely to miss an expense. It’s also easier to record your purchases during the month if there are lots of categories available. Then decide how much money you want to budget for each category for this month.

Add it all up. Subtract this number from your income. The goal is to be at $0. Dave Ramsey says, “If you cover all your expenses during the month and have $500 left over, you aren’t done with the budget yet. You must tell that 500 bucks where to go. If you don’t, you lose the chance to make it work for you in the areas of getting out of debt, saving for an emergency, investing, paying off the house, or growing wealth. Tell every dollar where to go.”

4. Live the Budget.

Now that the month has started, with your budget in hand, start living your life as normal. Do your groceries, pay your energy bill, and buy the new shoes. Just keep every receipt and write down what you spend. Every dollar you spend, keep track of it. This is part of the budget. If you don’t keep track of what you’re spending, how do you know if you’re close to within the range you had budgeted for that category?

That’s it. It’s as simple as INCOME – OUTGO = $0. Simple, you say? In theory, yes. In reality, absolutely not! Here are a few tips to help you along on your new budgeting journey.

- At the end of each day, input the receipts from that day into your budget. You will become overwhelmed quickly if you wait longer than a day or two to record what you’ve been spending. It takes about 60 seconds to write it down (even quicker if you’re budgeting online). Make the time to succeed.

- Once you’re comfortable with your average monthly budget (after 3 or 4 months), start sticking to your budget. It defeats the purpose of budgeting if you don’t follow it and continue to overspend. If you run out of money in one category, either steal some from another category (which means you’ll have to decrease your spending there) or just say no. Which means you may have to pass on dinner out with friends or put the lipstick back on the shelf. This is where self control and dedication come into play.

- Over-budget your grocery category, especially if you have a family to feed!

- Check out Mint.com. This is a free website that helps you organize all of your financial information in one user-friendly place. Makes budgeting a breeze!

- Practice makes perfect, and even then, you’ll still mess up! Go easy on yourself. Budgets are tough and messy. They are hard to maintain, especially in the instant-gratification world we live in. Set goals for yourself. Reward yourself if you meet a goal. Don’t beat yourself up if you fail one month. Simply keep on trying.

This is the cliff notes version of budgeting 101. A way to simply help you get started. You can’t dive deeper into anything until you first take the jump! If you need more help, why not check get in touch with business advisors like PKF Cooper Parry.

Photo credits: Laura Drayton Creative, Bizuza Printables, The Art of Making a Baby